Hi, I'm Ben!

I'm a Product enthusiast based out of Lexington, KY. I enjoy getting things done and the process + collaboration to ensure we're working on the right things to drive business impact.At my core, I'm a natural builder, finding joy in immersing myself in the details while maintaining a strategic perspective. I'm adept at diving into the weeds, bringing order to chaos, and crafting innovative strategies that encompass the big picture. It's this delicate balance that allows me to shape visions into reality, creating lasting value along the way.

Highlights & Skills

Product Strategy

Proficient in identifying and framing complex problems, crafting compelling product visions, and fostering seamless collaboration with cross-functional teams for successful execution

Business Acumen

Holistic business knowledge gained through working in a variety of domains (FinTech, InsurTech, Saas) and twelve years of operating a profitable Side Hustle that has generated $1.5m in revenue.

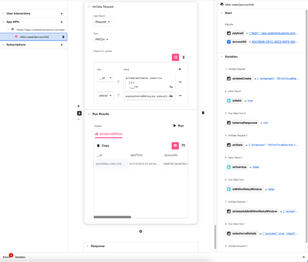

Low Code

Proficient in delivering working apps, in a fraction of the time and cost of traditional methods, to both validate concepts as functional prototypes and deliver value early

Salesforce Certified

2x certifications (Admin, Sales Cloud Consultant) and over 4 years of experience in enhancing Salesforce processes and functionality

Payments

3+ years of experience enhancing billing processes, managing money flow,s and optimizing payment processors

Experience

With over seven years of experience in product management, project management, and team leadership, I bring a data-driven approach to guide strategic decision-making and uncover valuable opportunities.Collaboration lies at the heart of my work—I thrive when collaborating with cross-functional teams to solve complex problems and drive real impact. As a true builder, I'm not afraid to dive into the details and take a hands-on approach to get things done.

Coterie Insurance (FinTech | InsurTech)

In the role of Product Manager at Coterie Insurance, I led initiatives across various domains:

Service: Spearheaded efforts to reduce incoming ticket volume while maintaining high customer satisfaction (CSAT) ratings. Successfully executed a migration from HubSpot to Salesforce Financial Services Cloud.

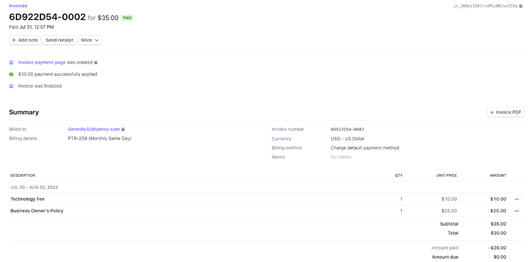

Payments: Led the revamp of the payment system to introduce automation and enhance billing processes. Implemented a robust Subscriptions and Invoicing model using Stripe Billing.

Data: Established new reporting capabilities to support the business, utilizing Power BI for data visualization and analysis.

Commonwealth Lacrosse, LLC (Service | Side Hustle)

As the Co-Founder and Director of Commonwealth Lacrosse, I have been responsible for a wide range of duties:

Designing and administering lacrosse programming for youth players

Managing hiring and firing processes

Overseeing financial planning and accounting

Handling IT operations and other related tasks

This experience has been profoundly influential in my professional development, teaching me invaluable skills such as strategic planning, team building, delegation, conflict management, and expectation management—essential qualities for any successful Product Manager or delivery lead.Noteworthy Achievements:

Generated over $1.5 million in revenue and paid $250k in wages to local employees since the program's inception.

Boast the longest-running club program in Kentucky, spanning several years.

Facilitated over 80 players in reaching collegiate level lacrosse.

Maintained a 95% player retention rate.

FormAssembly (SaaS)

As a Product Owner at FormAssembly, my focus was on driving improvements to our Integrations portfolio. I collaborated closely with UX and Engineering teams to revamp our in-app Billing experience, resulting in an 8% increase in trial conversions. Additionally, I delivered multiple enhancements to our core Salesforce integration, including the ability to attach form response PDFs to individual Salesforce records, leading to a 10% increase in connector satisfaction.

Projects

Here's a sample of notable projects I've had the privilege to work on. These are a testament to the power of teamwork and the incredible individuals I have had the opportunity to collaborate with along the way.

Coterie Insurance

InsurTech focused on small business insurance.

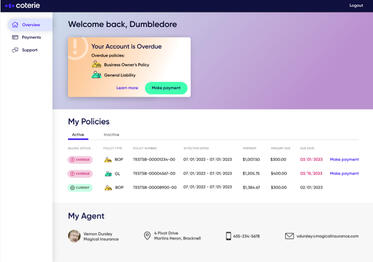

Self-service to the rescue!

Problem: Coterie faced the challenge of managing a substantial policyholder base, resulting in a high volume of incoming service requests. These requests varied in complexity and time required for resolution. To ensure optimal business growth, it became imperative for Coterie to decouple service team expansion from revenue growth.

Process: The discovery phase...

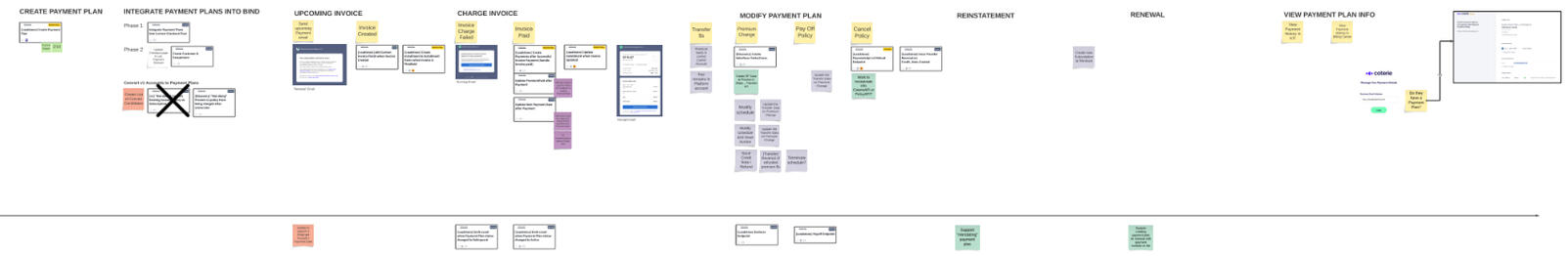

Payments Revamp

Problem: Coterie faced challenges with its existing billing system, originally designed for short-term policies rather than the typical 12-month policies that formed the core of its business. The system was patched together, leading to issues such as incorrect payments, data gaps, limited billing interval options, inflexibility in changing billing plans, and a lack of trigger points for future automation. These...

Resume

Follow this link to my resume in Google Drive!

Get in touch with me!

I’m currently available for full-time opportunities. Feel free to drop me a line if you’d like to chat sometime!

Self-service to the rescue!

Problem: Coterie faced the challenge of managing a substantial policyholder base, resulting in a high volume of incoming service requests. These requests varied in complexity and time required for resolution. To ensure optimal business growth, it became imperative for Coterie to decouple service team expansion from revenue growth.

Process: The discovery phase involved understanding the different types of incoming work and profiling each task based on complexity, time requirements, and potential challenges. A strategic decision was made to prioritize offloading these tasks through self-service options rather than solely optimizing existing processes. In order to identify the tasks policyholders and agents could handle themselves, extensive interviews were conducted. This process yielded a prioritized list of service work targets that could be addressed.

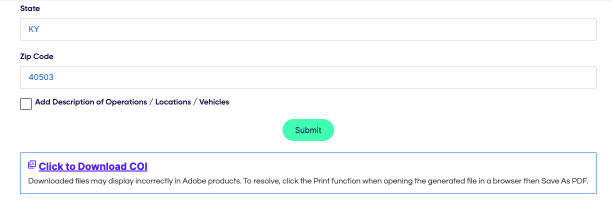

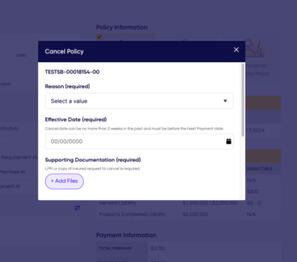

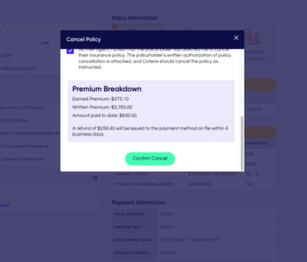

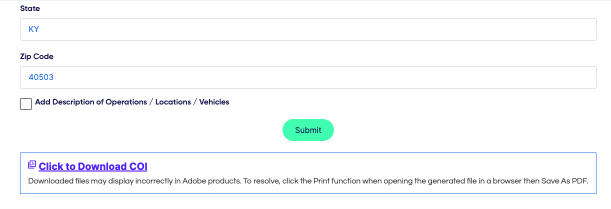

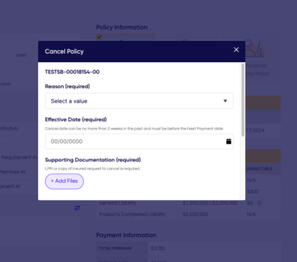

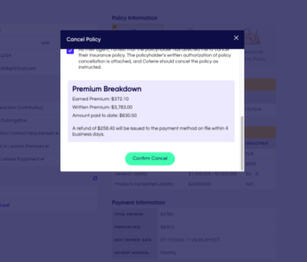

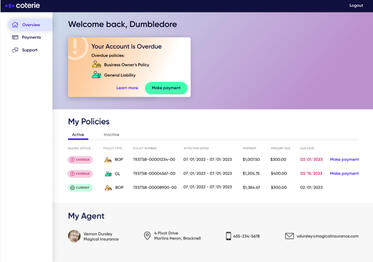

Solution: The solution involved developing a suite of self-service tools, starting with a user-friendly billing portal for policyholders to manage their billing and payment needs. Utilizing low-code tools like AirKit, functional service prototypes were integrated into the Coterie toolkit. This approach allowed for rapid concept validation while delivering tangible value (reduced workload for the Service team) within a matter of weeks instead of months. These experiments included features such as certificate of insurance generation for agents and policyholders, as well as policy cancellation capabilities for agents.

Impact: The impact of these efforts was substantial, with 8,500 service requests fulfilled within a span of three months. Each fulfilled request meant one less case in the Customer Advocacy queue, resulting in an 18% reduction in incoming tickets. By leveraging self-service tools and streamlining the service process, Coterie successfully achieved significant operational efficiency and improved customer satisfaction.

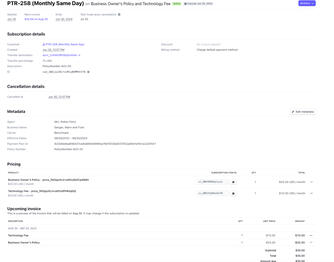

Payments Revamp

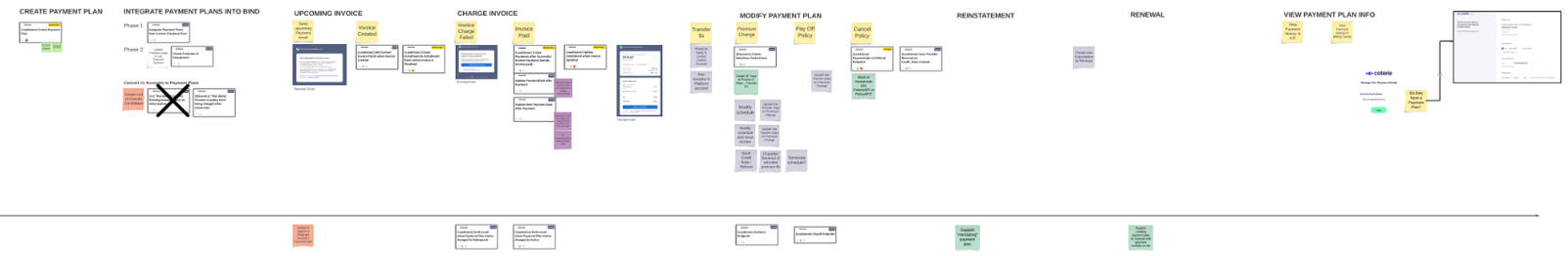

Problem: Coterie faced challenges with its existing billing system, originally designed for short-term policies rather than the typical 12-month policies that formed the core of its business. The system was patched together, leading to issues such as incorrect payments, data gaps, limited billing interval options, inflexibility in changing billing plans, and a lack of trigger points for future automation. These problems resulted in a subpar billing user experience and, in some cases, reduced policy retention.

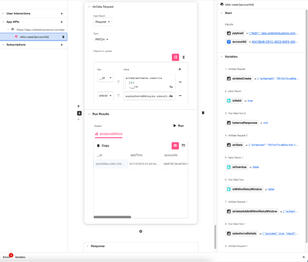

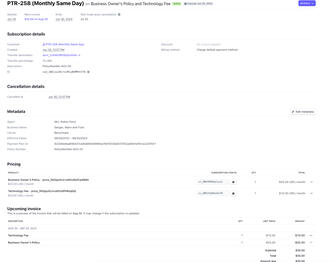

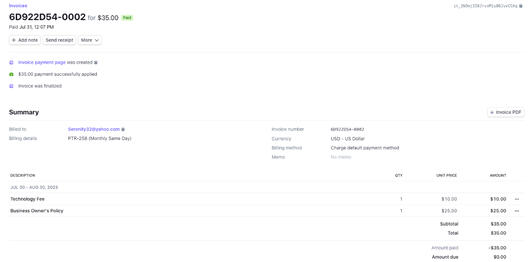

Process: A comprehensive two-month discovery phase commenced, beginning with customer research and validation of pain points and areas for improvement. The findings from these workshops informed the development of a story map, outlining the desired billing experience. Proof of concepts were then created and iterated upon to ensure feasibility within the existing product and scalability for future offerings.

Solution: To address these challenges, we opted to leverage the robust ecosystem of Stripe, a leading payment platform, rather than building our own billing tools. By integrating deeply with Stripe's "Billing" offering, specifically Subscriptions and Subscription Schedules, we could offload charging behavior to Stripe, allowing Coterie to focus on their core value proposition in insurance products and distribution. Data stores were set up to listen to Stripe events, such as Invoice Paid or Failed, enabling the creation of revenue history records to track invoice and payment history for each policy. This event-driven structure also facilitated the introduction of more advanced automation, such as automatic handling of non-payment cancellations when a subscription entered the dunning phase.